•

•

•

•

•

•

1

•

•

2

•

•

3

•

•

4

•

•

5

•

•

6

•

•

7

•

•

8

•

•

9

•

•

10

•

•

11

•

•

12

•

•

13

•

•

14

•

•

15

•

•

16

•

•

17

•

•

18

•

•

19

•

•

20

•

•

21

•

•

22

•

•

23

•

•

24

•

•

25

•

•

•

•

•

•

•

•

•

•

•

1

•

•

2

•

•

3

•

•

4

•

•

5

•

•

6

•

•

7

•

•

8

•

•

9

•

•

10

•

•

11

•

•

12

•

•

13

•

•

14

•

•

15

•

•

16

•

•

17

•

•

18

•

•

19

•

•

20

•

•

21

•

•

22

•

•

23

•

•

24

•

•

25

•

•

26

•

•

27

•

•

28

•

•

29

•

•

30

•

•

•

•

•

•

•

•

•

•

•

•

1

•

•

2

•

•

3

•

•

4

•

•

5

•

•

6

•

•

7

•

•

8

•

•

9

•

•

10

•

•

11

•

•

12

•

•

13

•

•

14

•

•

15

•

•

16

•

•

•

•

•

•

•

•

•

•

1

•

•

2

•

•

3

•

•

4

•

•

5

•

•

6

•

•

7

•

•

8

•

•

9

•

•

10

•

•

11

•

•

12

•

•

13

•

•

14

•

•

15

•

•

16

•

•

•

•

•

•

•

•

1

•

•

2

•

•

3

•

•

4

•

•

5

•

•

6

•

•

7

•

•

8

•

•

9

•

•

10

•

•

11

•

•

12

•

•

13

•

•

14

•

•

15

•

•

16

•

•

•

•

hello@amercer.com

Click to Copy!

Copied!

Strategic Finance Consultant

Strategic Finance Consultant

Strategic Finance Consultant

Raise from the best investors Faster and smarter

R

a

i

s

e

f

r

o

m

t

h

e

b

e

s

t

i

n

v

e

s

t

o

r

s

F

a

s

t

e

r

a

n

d

s

m

a

r

t

e

r

Raise from the best investors Faster and smarter

R

a

i

s

e

f

r

o

m

t

h

e

b

e

s

t

i

n

v

e

s

t

o

r

s

F

a

s

t

e

r

a

n

d

s

m

a

r

t

e

r

Raise from the best investors Faster and smarter

R

a

i

s

e

f

r

o

m

t

h

e

b

e

s

t

i

n

v

e

s

t

o

r

s

F

a

s

t

e

r

a

n

d

s

m

a

r

t

e

r

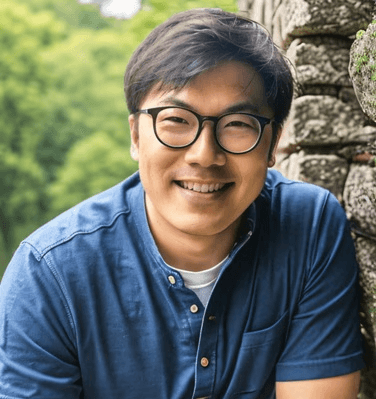

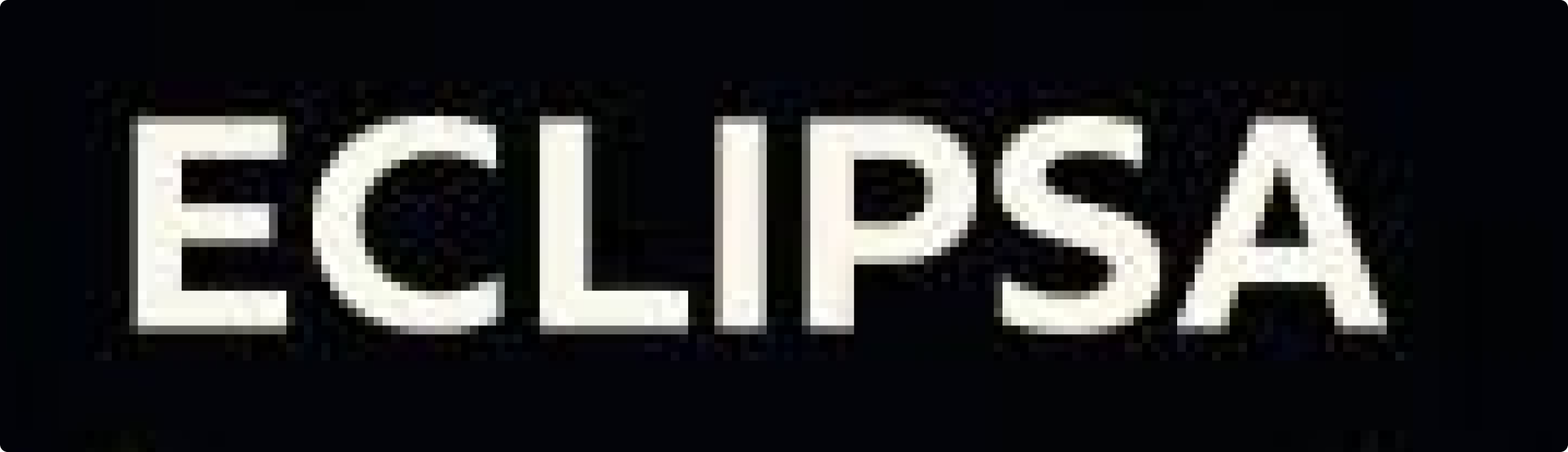

Hi, I’m Lex. I’ve been on both sides of the table - building & investing. I help tech founders nail fundraising, finance and investor relations. No fluff. No BS.

Trusted by high-growth startups, from bootstrapped to VC-backed

Trusted by high-growth startups, from bootstrapped to VC-backed

Trusted by high-growth startups, from bootstrapped to VC-backed

Introduction

Over the past decade, I’ve worn a few hats - founder, VC investor, and advisor. I’ve co-founded and scaled a startup, raised capital, and had the privilege of investing in 30+ companies while advising 50+ others on everything from Fundraising and Investor Relations to Finance Ops and M&A. The founders I’ve worked with have collectively gone on to raise billions.

Over the past decade, I’ve worn a few hats - founder, VC investor, and advisor. I’ve co-founded and scaled a startup, raised capital, and had the privilege of investing in 30+ companies while advising 50+ others on everything from Fundraising and Investor Relations to Finance Ops and M&A. The founders I’ve worked with have collectively gone on to raise billions.

Over the past decade, I’ve worn a few hats - founder, VC investor, and advisor. I’ve co-founded and scaled a startup, raised capital, and had the privilege of investing in 30+ companies while advising 50+ others on everything from Fundraising and Investor Relations to Finance Ops and M&A. The founders I’ve worked with have collectively gone on to raise billions.

With a background in accounting and M&A, I’ve built finance systems from scratch, run due diligence as both a VC investor and a strategic buyer, and set up fund structures across the UK and the US.

If there’s one thing I’ve learned through it all, it’s that building is hard. The market’s noisy, and a founder’s most limited resource isn’t capital - it’s time.

If there’s one thing I’ve learned through it all, it’s that building is hard. The market’s noisy, and a founder’s most limited resource isn’t capital - it’s time.

That’s why I’ve pulled together a curated list of resources (see below) I’ve found genuinely useful - free tools, leads for fundraising/hiring and other shortcuts to help you move faster, stay lean, and focus on what matters most.

That’s why I’ve pulled together a curated list of resources (see below) I’ve found genuinely useful - free tools, leads for fundraising/hiring and other shortcuts to help you move faster, stay lean, and focus on what matters most.

That’s why I’ve pulled together a curated list of resources (see below) I’ve found genuinely useful - free tools, leads for fundraising/hiring and other shortcuts to help you move faster, stay lean, and focus on what matters most.

Common questions everyone faces

How much traction do I need for a strong fundraise?

How much traction do I need for a strong fundraise?

How much traction do I need for a strong fundraise?

How should I set up the finance systems for growth?

How should I set up the finance systems for growth?

How should I set up the finance systems for growth?

What are the key metrics investors care about?

What are the key metrics investors care about?

What are the key metrics investors care about?

Who are the right investors for us?

Who are the right investors for us?

Who are the right investors for us?

How should we run the fundraising process efficiently?

How should we run the fundraising process efficiently?

How should we run the fundraising process efficiently?

Should we be raising equity or debt?

Should we be raising equity or debt?

Should we be raising equity or debt?

Bespoke Services

Fundraising readiness workshop

£950

/1 day

Deep dive into market, competition, defensibility and vision

Identify areas of improvement and unique insights of your business

Draft unique story for your pitch

Explore multiple sources of funding

Identify Ideal Investor Profile and Go-To-Raise strategy

Ideal for founders who are thinking about fundraising in the next 3-6 months and want to start preparing.

Seed to Series B Fundraise

Custom Pricing

Prepare marketing materials including pitch deck and elevator pitch

Prepare data room including financial model, cap table, FAQ

Prepare list of investors and outreach template

Provide warm introduction to relevant investors

Term sheet and legals negotiation

Fractional CFO

Custom Pricing

Set up accounting & HR processes

Accounting & Policies Audit

Budget modelling & cash flow forecasting

Investor Relations & Board Packs

M&A strategy and target due diligence

Prepare business for an exit

Prepare business for an exit

Fundraising readiness workshop

£950

/1 day

Deep dive into market, competition, defensibility and vision

Identify areas of improvement and unique insights of your business

Draft unique story for your pitch

Explore multiple sources of funding

Identify Ideal Investor Profile and Go-To-Raise strategy

Ideal for founders who are thinking about fundraising in the next 3-6 months and want to start preparing.

Fractional CFO

Custom Pricing

Set up accounting & HR processes

Accounting & Policies Audit

Budget modelling & cash flow forecasting

Investor Relations & Board Packs

M&A strategy and target due diligence

Prepare business for an exit

Prepare business for an exit

Seed to Series B Fundraise

Custom Pricing

Prepare marketing materials including pitch deck and elevator pitch

Prepare data room including financial model, cap table, FAQ

Prepare list of investors and outreach template

Provide warm introduction to relevant investors

Term sheet and legals negotiation

Fundraising readiness workshop

£950

/1 day

Deep dive into market, competition, defensibility and vision

Identify areas of improvement and unique insights of your business

Draft unique story for your pitch

Explore multiple sources of funding

Identify Ideal Investor Profile and Go-To-Raise strategy

Ideal for founders who are thinking about fundraising in the next 3-6 months and want to start preparing.

Seed to Series B Fundraise

Custom Pricing

Prepare marketing materials including pitch deck and elevator pitch

Prepare data room including financial model, cap table, FAQ

Prepare list of investors and outreach template

Provide warm introduction to relevant investors

Term sheet and legals negotiation

Fractional CFO

Custom Pricing

Set up accounting & HR processes

Accounting & Policies Audit

Budget modelling & cash flow forecasting

Investor Relations & Board Packs

M&A strategy and target due diligence

Prepare business for an exit

Prepare business for an exit

Trusted by 30+ founders across DeepTech, B2B SaaS and Consumer sectors

Trusted by 30+ founders across DeepTech, B2B SaaS and Consumer sectors

Lex has been an incredible partner to Perlego since our seed stage. His advice across fundraising, investor negotiations, and product strategy has always been practical, grounded, and refreshingly no-BS.

Gauthier van Malderen

CEO and Cofounder of Perlego

Edtech

Series B

Fundraising

Product

Lex’s support since our seed stage has been incredible. From fundraising and investor intros to helping us successfully launch in a new market. His analysis and wisdom has always helped us all along.

Vishal Joshi

CEO and Cofounder of Joy

Consumer

Series C

Fundraising

GTM

Lex has been an incredible advisor to us at Verto, from his VC days to now as a fellow founder. He’s helped us think through our fundraising strategy, sharpen our financial model, and connect with the right investors. He’s always there to bounce ideas off, and his input was a big part of why our fundraise went so well.

Ola Oyetayo

CEO and Cofounder of Verto

Fintech

Series B

Fundraising

Finance

Lex was instrumental in helping us navigate our fundraising process. He brought clarity to our financial model, helped us articulate the right story to investors, and guided us through every stage of the raise with a calm, strategic approach. Beyond the numbers, he acted as a true thought partner, someone who could balance financial rigor with startup realities. I’d highly recommend him to any founder looking for a fractional CFO who genuinely adds value.

Rea Liu

CEO and Cofounder of Eclipsa AI

Marketing

Seed

Fundraising

Finance

Lex helped refine our pitch and opened doors to great investors -his input directly helped us raise at a higher valuation.

Ankit Khandelwal

CEO and Founder of Gromo

Fintech

Series A

Fundraising

.

As an early-stage founder, Lex’s guidance was super valuable. He cut through the noise and helped me focus on my top priorities, including the best approach for working with design partners, and fundraising strategy and story. Since he has been both an operator and an investor, he has a unique perspective which really came through in his guidance.

Anonymous

Cofounder of stealth startup

Fintech

Preseed

PMF

.

Lex has been a great partner to Deed since our seed round. He’s helped us get investor-ready for the next big raise, made key customer and investor introductions, and supported us through negotiations every step of the way.

Steven Liu

CEO and Cofounder of Deed

B2B SaaS

Series A

Fundraising

GTM

Since our Series A, Lex has been a trusted advisor - supporting us with fundraising, investor connections, and deep market and competitive analysis. His guidance on market expansion was practical, hands-on, and helped us avoid common pitfalls.

Hendra Kwik

CEO and Cofounder of Fazz

Fintech

Series C

Fundraising

GTM

Honestly, that chat really helped. You got me to think differently about fundraising - especially the part about working backwards from what we actually want to achieve instead of just picking a number that feels safe. After we talked, my deck was way tighter and my narrative made way more sense. Felt a lot more confident going into conversations.

Kunal Sharma

CEO and Cofounder of Refix AI

B2B SaaS

Series A

Fundraising

.

As an investor of Onfolk, Lex has consistently been responsive and supportive. Now that he has startup experience, I'm sure he'll be a great asset to any business

Naz Malik

CEO and Cofounder of Onfolk

B2B SaaS

Seed

Strategy

.

Lex has been an incredible investor to work with - always there when we needed advice or support. His thoughtful input was especially valuable when we pivoted the business and kicked off a new fundraise. He also went out of his way to make introductions to investors and potential partners who ended up being really helpful.

Sascha MacKinnon

CEO and Cofounder of Mino Games

Consumer

Series A

Fundraising

Strategy

Lex was a big help during our fundraising process - connecting us with investors and guiding our product and GTM strategy by sharing insights from what’s worked (and what hasn’t) in other markets.

Fahad Kamr

CEO and Founder of Udhaar

Fintech

Seed

Fundraising

GTM

I first met Lex when I was fundraising. He helped me see the competitive landscape more clearly than anyone else. What stood out was how much he actually cared. He didn’t just give advice; he made introductions, did real work, and followed through. Whenever I was stuck or just needed to think something through, he was my first call. When I was considering an acquisition, he walked me through it, helped me find the right broker, and told me what to watch out for, and I only now realize how valuable that advice was.

Mohit Prateek

CEO and Cofounder of Anakin

B2B SaaS

Series A

Fundraising

Strategy

Lex is a no‑BS coach who quickly exposed what we were missing to sharpen our market focus. He helped us see we were focusing too much on a single customer vertical (water utilities) which would not let us scale fast enough to be VC-investable.

Diego Muñoz Iglesias

CEO and Cofounder of Lir Labs

Deeptech

Pre-seed

Fundraising

Strategy

Lex was incredibly helpful during my pre-seed raise - he helped refine my pitch deck, structure my data room, and made valuable introductions to investors.

Philippe de Liedekerke

CEO and Founder of IFREQ

Sports tech

Pre-seed

Fundraising

.

I worked with Lex over the last 5 years. He has been a pleasure to work with and has been a great resource for me when building our SaaS business!

Richy Nelson

CEO and Cofounder of Roofr

B2B SaaS

Series B

Fundraising

Strategy

Lex was incredibly helpful during our fundraise. He connected us with several highly relevant investors and worked closely with us to refine our pitch so our story really resonated. He’s a great sounding board with a deep understanding of how VCs think and on the current fundraising market.

Hakkawise

CEO and Cofounder of Hakkawise

B2B SaaS

Seed

Fundraising

.

Lex is extremely knowledgeable about fundraising for early stage startups and gave us amazing 'veteran' advice for defining our ICP and thinking through our differentiation. My co-founder and I left the meeting with a clearer idea of how to think about our strategy and market positioning.

Anonymous

Cofounder of stealth startup

B2B SaaS

Preseed

Fundraising

.

Show more

Lex has been an incredible partner to Perlego since our seed stage. His advice across fundraising, investor negotiations, and product strategy has always been practical, grounded, and refreshingly no-BS.

Gauthier van Malderen

CEO and Cofounder of Perlego

Edtech

Series B

Fundraising

Product

Lex’s support since our seed stage has been incredible. From fundraising and investor intros to helping us successfully launch in a new market. His analysis and wisdom has always helped us all along.

Vishal Joshi

CEO and Cofounder of Joy

Consumer

Series C

Fundraising

GTM

Lex has been an incredible advisor to us at Verto, from his VC days to now as a fellow founder. He’s helped us think through our fundraising strategy, sharpen our financial model, and connect with the right investors. He’s always there to bounce ideas off, and his input was a big part of why our fundraise went so well.

Ola Oyetayo

CEO and Cofounder of Verto

Fintech

Series B

Fundraising

Finance

Lex was instrumental in helping us navigate our fundraising process. He brought clarity to our financial model, helped us articulate the right story to investors, and guided us through every stage of the raise with a calm, strategic approach. Beyond the numbers, he acted as a true thought partner, someone who could balance financial rigor with startup realities. I’d highly recommend him to any founder looking for a fractional CFO who genuinely adds value.

Rea Liu

CEO and Cofounder of Eclipsa AI

Marketing

Seed

Fundraising

Finance

Lex helped refine our pitch and opened doors to great investors -his input directly helped us raise at a higher valuation.

Ankit Khandelwal

CEO and Founder of Gromo

Fintech

Series A

Fundraising

.

As an early-stage founder, Lex’s guidance was super valuable. He cut through the noise and helped me focus on my top priorities, including the best approach for working with design partners, and fundraising strategy and story. Since he has been both an operator and an investor, he has a unique perspective which really came through in his guidance.

Anonymous

Cofounder of stealth startup

Fintech

Preseed

PMF

.

Lex has been a great partner to Deed since our seed round. He’s helped us get investor-ready for the next big raise, made key customer and investor introductions, and supported us through negotiations every step of the way.

Steven Liu

CEO and Cofounder of Deed

B2B SaaS

Series A

Fundraising

GTM

Since our Series A, Lex has been a trusted advisor - supporting us with fundraising, investor connections, and deep market and competitive analysis. His guidance on market expansion was practical, hands-on, and helped us avoid common pitfalls.

Hendra Kwik

CEO and Cofounder of Fazz

Fintech

Series C

Fundraising

GTM

Honestly, that chat really helped. You got me to think differently about fundraising - especially the part about working backwards from what we actually want to achieve instead of just picking a number that feels safe. After we talked, my deck was way tighter and my narrative made way more sense. Felt a lot more confident going into conversations.

Kunal Sharma

CEO and Cofounder of Refix AI

B2B SaaS

Series A

Fundraising

.

As an investor of Onfolk, Lex has consistently been responsive and supportive. Now that he has startup experience, I'm sure he'll be a great asset to any business

Naz Malik

CEO and Cofounder of Onfolk

B2B SaaS

Seed

Strategy

.

Lex has been an incredible investor to work with - always there when we needed advice or support. His thoughtful input was especially valuable when we pivoted the business and kicked off a new fundraise. He also went out of his way to make introductions to investors and potential partners who ended up being really helpful.

Sascha MacKinnon

CEO and Cofounder of Mino Games

Consumer

Series A

Fundraising

Strategy

Lex was a big help during our fundraising process - connecting us with investors and guiding our product and GTM strategy by sharing insights from what’s worked (and what hasn’t) in other markets.

Fahad Kamr

CEO and Founder of Udhaar

Fintech

Seed

Fundraising

GTM

I first met Lex when I was fundraising. He helped me see the competitive landscape more clearly than anyone else. What stood out was how much he actually cared. He didn’t just give advice; he made introductions, did real work, and followed through. Whenever I was stuck or just needed to think something through, he was my first call. When I was considering an acquisition, he walked me through it, helped me find the right broker, and told me what to watch out for, and I only now realize how valuable that advice was.

Mohit Prateek

CEO and Cofounder of Anakin

B2B SaaS

Series A

Fundraising

Strategy

Lex is a no‑BS coach who quickly exposed what we were missing to sharpen our market focus. He helped us see we were focusing too much on a single customer vertical (water utilities) which would not let us scale fast enough to be VC-investable.

Diego Muñoz Iglesias

CEO and Cofounder of Lir Labs

Deeptech

Pre-seed

Fundraising

Strategy

Lex was incredibly helpful during my pre-seed raise - he helped refine my pitch deck, structure my data room, and made valuable introductions to investors.

Philippe de Liedekerke

CEO and Founder of IFREQ

Sports tech

Pre-seed

Fundraising

.

I worked with Lex over the last 5 years. He has been a pleasure to work with and has been a great resource for me when building our SaaS business!

Richy Nelson

CEO and Cofounder of Roofr

B2B SaaS

Series B

Fundraising

Strategy

Lex was incredibly helpful during our fundraise. He connected us with several highly relevant investors and worked closely with us to refine our pitch so our story really resonated. He’s a great sounding board with a deep understanding of how VCs think and on the current fundraising market.

Hakkawise

CEO and Cofounder of Hakkawise

B2B SaaS

Seed

Fundraising

.

Lex is extremely knowledgeable about fundraising for early stage startups and gave us amazing 'veteran' advice for defining our ICP and thinking through our differentiation. My co-founder and I left the meeting with a clearer idea of how to think about our strategy and market positioning.

Anonymous

Cofounder of stealth startup

B2B SaaS

Preseed

Fundraising

.

Show more

Lex has been an incredible partner to Perlego since our seed stage. His advice across fundraising, investor negotiations, and product strategy has always been practical, grounded, and refreshingly no-BS.

Gauthier van Malderen

CEO and Cofounder of Perlego

Edtech

Series B

Fundraising

Product

Lex’s support since our seed stage has been incredible. From fundraising and investor intros to helping us successfully launch in a new market. His analysis and wisdom has always helped us all along.

Vishal Joshi

CEO and Cofounder of Joy

Consumer

Series C

Fundraising

GTM

Lex has been an incredible advisor to us at Verto, from his VC days to now as a fellow founder. He’s helped us think through our fundraising strategy, sharpen our financial model, and connect with the right investors. He’s always there to bounce ideas off, and his input was a big part of why our fundraise went so well.

Ola Oyetayo

CEO and Cofounder of Verto

Fintech

Series B

Fundraising

Finance

Lex was instrumental in helping us navigate our fundraising process. He brought clarity to our financial model, helped us articulate the right story to investors, and guided us through every stage of the raise with a calm, strategic approach. Beyond the numbers, he acted as a true thought partner, someone who could balance financial rigor with startup realities. I’d highly recommend him to any founder looking for a fractional CFO who genuinely adds value.

Rea Liu

CEO and Cofounder of Eclipsa AI

Marketing

Seed

Fundraising

Finance

Lex helped refine our pitch and opened doors to great investors -his input directly helped us raise at a higher valuation.

Ankit Khandelwal

CEO and Founder of Gromo

Fintech

Series A

Fundraising

.

As an early-stage founder, Lex’s guidance was super valuable. He cut through the noise and helped me focus on my top priorities, including the best approach for working with design partners, and fundraising strategy and story. Since he has been both an operator and an investor, he has a unique perspective which really came through in his guidance.

Anonymous

Cofounder of stealth startup

Fintech

Preseed

PMF

.

Lex has been a great partner to Deed since our seed round. He’s helped us get investor-ready for the next big raise, made key customer and investor introductions, and supported us through negotiations every step of the way.

Steven Liu

CEO and Cofounder of Deed

B2B SaaS

Series A

Fundraising

GTM

Since our Series A, Lex has been a trusted advisor - supporting us with fundraising, investor connections, and deep market and competitive analysis. His guidance on market expansion was practical, hands-on, and helped us avoid common pitfalls.

Hendra Kwik

CEO and Cofounder of Fazz

Fintech

Series C

Fundraising

GTM

Honestly, that chat really helped. You got me to think differently about fundraising - especially the part about working backwards from what we actually want to achieve instead of just picking a number that feels safe. After we talked, my deck was way tighter and my narrative made way more sense. Felt a lot more confident going into conversations.

Kunal Sharma

CEO and Cofounder of Refix AI

B2B SaaS

Series A

Fundraising

.

As an investor of Onfolk, Lex has consistently been responsive and supportive. Now that he has startup experience, I'm sure he'll be a great asset to any business

Naz Malik

CEO and Cofounder of Onfolk

B2B SaaS

Seed

Strategy

.

Lex has been an incredible investor to work with - always there when we needed advice or support. His thoughtful input was especially valuable when we pivoted the business and kicked off a new fundraise. He also went out of his way to make introductions to investors and potential partners who ended up being really helpful.

Sascha MacKinnon

CEO and Cofounder of Mino Games

Consumer

Series A

Fundraising

Strategy

Lex was a big help during our fundraising process - connecting us with investors and guiding our product and GTM strategy by sharing insights from what’s worked (and what hasn’t) in other markets.

Fahad Kamr

CEO and Founder of Udhaar

Fintech

Seed

Fundraising

GTM

I first met Lex when I was fundraising. He helped me see the competitive landscape more clearly than anyone else. What stood out was how much he actually cared. He didn’t just give advice; he made introductions, did real work, and followed through. Whenever I was stuck or just needed to think something through, he was my first call. When I was considering an acquisition, he walked me through it, helped me find the right broker, and told me what to watch out for, and I only now realize how valuable that advice was.

Mohit Prateek

CEO and Cofounder of Anakin

B2B SaaS

Series A

Fundraising

Strategy

Lex is a no‑BS coach who quickly exposed what we were missing to sharpen our market focus. He helped us see we were focusing too much on a single customer vertical (water utilities) which would not let us scale fast enough to be VC-investable.

Diego Muñoz Iglesias

CEO and Cofounder of Lir Labs

Deeptech

Pre-seed

Fundraising

Strategy

Lex was incredibly helpful during my pre-seed raise - he helped refine my pitch deck, structure my data room, and made valuable introductions to investors.

Philippe de Liedekerke

CEO and Founder of IFREQ

Sports tech

Pre-seed

Fundraising

.

I worked with Lex over the last 5 years. He has been a pleasure to work with and has been a great resource for me when building our SaaS business!

Richy Nelson

CEO and Cofounder of Roofr

B2B SaaS

Series B

Fundraising

Strategy

Lex was incredibly helpful during our fundraise. He connected us with several highly relevant investors and worked closely with us to refine our pitch so our story really resonated. He’s a great sounding board with a deep understanding of how VCs think and on the current fundraising market.

Hakkawise

CEO and Cofounder of Hakkawise

B2B SaaS

Seed

Fundraising

.

Lex is extremely knowledgeable about fundraising for early stage startups and gave us amazing 'veteran' advice for defining our ICP and thinking through our differentiation. My co-founder and I left the meeting with a clearer idea of how to think about our strategy and market positioning.

Anonymous

Cofounder of stealth startup

B2B SaaS

Preseed

Fundraising

.

Show more

Founder Resources

I talk to founders every week and hear the same frustrations. So I built the tools I wish they’d had - practical presentations and curated databases to help you move faster and stay capital-efficient. One of them is a UK angel investor database for early-stage founders, segmented by sector and portfolio. Click below to access the database and other free founder resources.

© 2026 withlex.io All rights reserved.

© 2026 withlex.io All rights reserved.

© 2026 withlex.io All rights reserved.